Pharmaceutical companies that have not yet completed clinical trials appear increasingly anxious about Wegovy’s early dominance in the market. This is not surprising—in the pharmaceutical industry, the first drug to gain recognition often enjoys a lasting imprint on public perception. Take for example Bayer’s Aspirin, Prozac for depression, or Pfizer’s Viagra and Propecia, well-known for erectile dysfunction and hair loss, respectively. Now, when people think of anti-obesity medications, it's almost certain that Wegovy will come to mind first.

However, many pharmaceutical companies view Wegovy’s injectable form as a potential weakness, and are racing to develop oral anti-obesity treatments instead. The company expected to be first to launch such a product is Eli Lilly. The company’s oral version is currently in Phase 3 clinical trials and has shown promising efficacy and safety results. Given that Eli Lilly has already launched an injectable weight-loss drug called Zepbound, its pursuit of the oral market is expected to be particularly aggressive. But will Eli Lilly corner the market on oral obesity treatments?

|

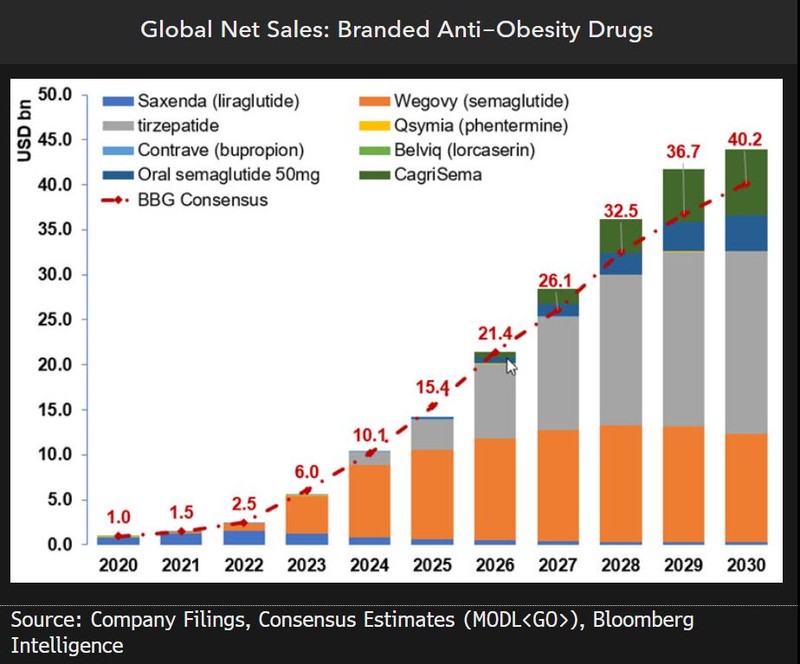

| Anti-Obesity Drugs Market Size |

A look at developments among Korean pharmaceutical companies suggests the competition could be intense. Among domestic firms, Hanmi Pharmaceutical is seen as the front-runner. Hanmi holds more registered patents in the GLP-1 category than Novo Nordisk, the maker of Wegovy. Other Korean companies being mentioned in industry circles include Il-Dong Pharmaceutical and D&D Pharmatech.

Il-Dong, in particular, is conducting Phase 1 clinical trials in Korea for an oral GLP-1-based treatment through its R&D subsidiary Unovia. The trial, which began in August 2024, is expected to conclude sometime in 2025. Notably, the drug is being developed as a synthetic small-molecule compound, which differentiates it from existing injectable medications and is expected to make manufacturing easier and more cost-effective.

D&D Pharmatech has also entered the race, currently conducting Phase 1 clinical trials in the United States, with first patient dosing initiated in November 2024. The company has out-licensed six anti-obesity drug candidates to its U.S. partner company, Metcela, with patient dosing already underway for its lead oral drug candidate. Development of this compound has been accelerated by the company’s proprietary oral platform technology, “Oralink,” which was recently granted a patent in Japan. Backed by this technological foundation, D&D is focusing on high-absorption oral therapies and expects to build a virtuous development cycle that links lead candidates with future follow-on drugs.

Global market forecasts for anti-obesity therapeutics by 2030 vary widely, with estimates ranging from 80 trillion to 200 trillion KRW (approximately $60–150 billion USD). The large spread is due to the fact that no oral anti-obesity drug has been commercialized yet. Once oral therapies are introduced, however, the market is expected to expand significantly thanks to ease of administration, patient compliance, and greater clinical efficiency—forming a potential 100-trillion-won value-add market.

Thus, even if Eli Lilly releases its first oral anti-obesity drug by 2026, it doesn’t necessarily signal a loss for its Korean competitors. On the contrary, their entry into the market could be well-timed to capture pent-up demand, meaning that success for followers may already be within reach.

By the end of this year, a clearer picture of the market landscape is expected to emerge. The key question will be whether early entrants will solidify a dominant market position, or whether they will simply pave the way for latecomers to thrive. If a sufficient supply of oral anti-obesity medications enters the market, it's likely that usage will expand beyond therapeutic needs to include cosmetic and lifestyle applications. For those who have long worried about weight gain, the future may even hold the possibility of indulging for a year, then comfortably losing weight with a pill.

No comments:

Post a Comment