K-원전의 미래에 대해 윤석열은 무슨 짓을 저질렀나?

윤석열은 그간 문재인 정부가 한국의 원전 생태계를 망쳐놓았다며 엄청나게 욕을 해댔다. 그러면서 미국부터 시작해서 전 세계 원전 건설 수요에 한국 원전기술이 대응할 수 있다고 거짓말을 해댔다.

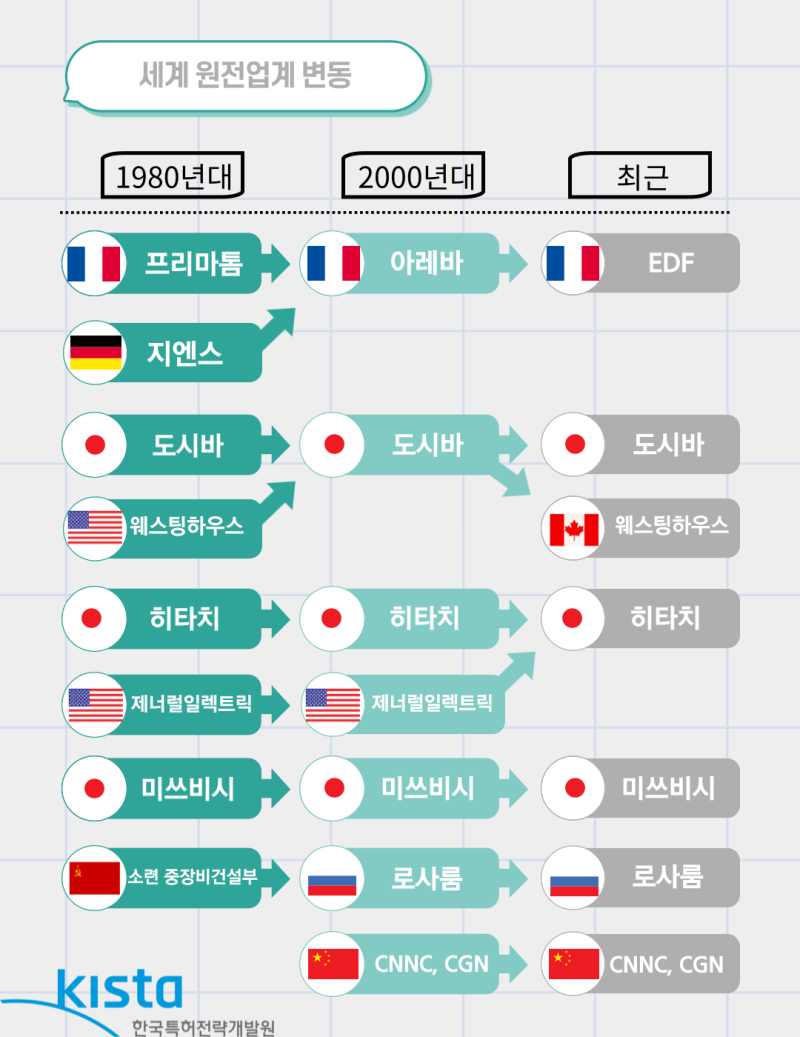

실상은 이미 훨씬 전부터 한국의 원전기술은 미국에 종속되어 있었다. 만일 그렇지 않고 기술적인 자립에 성공했다면, 웨스팅하우스(Westinghouse)의 원천기술에 맥을 못추는 지금의 상황은 빚어지지 않았을 것이다. 원천기술만이 아니라, 후속 특허와 패밀리 특허를 포함해 5만 건이 넘는 특허를 보유하고 있다.

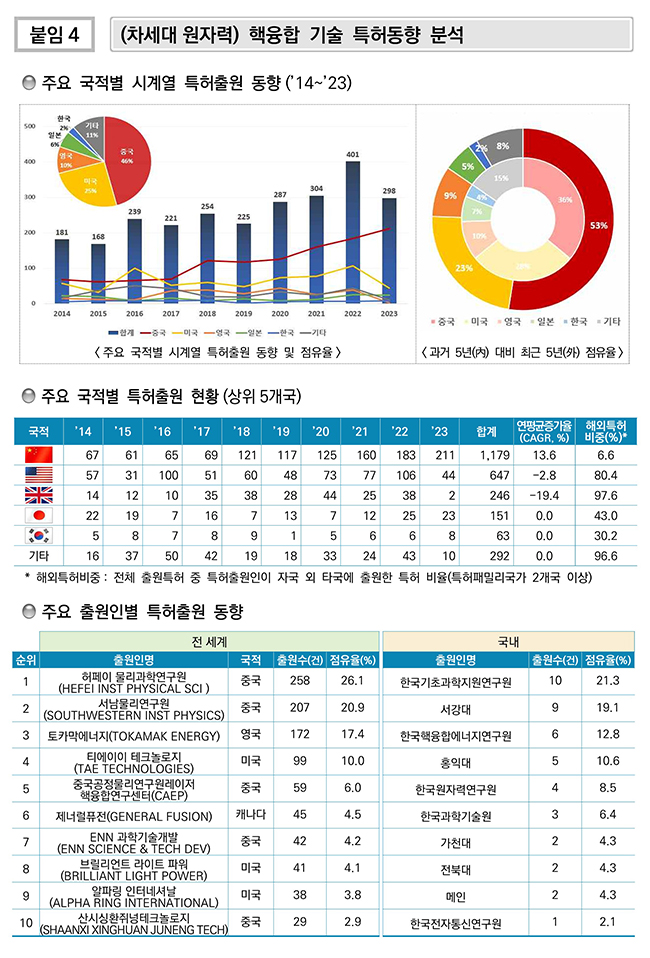

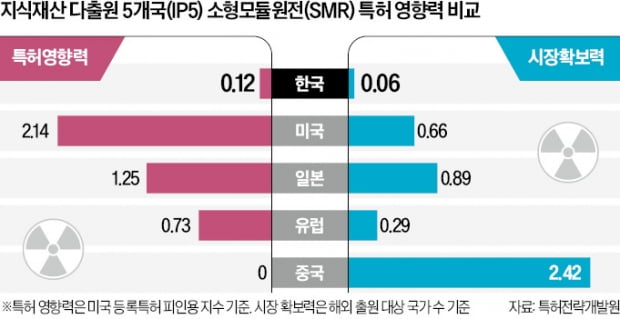

원자력 기술에 대한 간단한 특허분석만 해봐도, 한국은 원천기술이 아니 주변기술이나 구동기술에 한정된 기술개발과 부수적인 특허들을 보유하고 있음을 알 수 있다. 그리고 이미 기술부족, 특허부족 등 우리의 뒤처진 기술력에 대한 경고성 조사분석들이 지속적으로 보고되었다.

심지어 차세대 원자로와 관련해서도, 중국의 1/4도 안 되는 수의 특허를 가지고 세계 진출을 어떻게 한다는 것인지 도무지 이해를 할 수 없다.

차라리 체코와의 원전 수주 계약을 이토록 온 세계 방방곡곡에 떠들어 대지만 않았어도, 웨스팅하우스가 한국이 체코에 구현하려는 원전기술들을 그토록 상세하게 들여다보지는 않았을 지도 모른다.

한국 원전의 수출길을 완벽하게 틀어 막아버린 윤석열

물론 그런 요량을 바라고 어줍잖게 원전수출을 도모하는 것도 결국은 불가능한 일로 귀결이 되고 말았을 것이다. 그런데 보다 중요한 사실은 윤석열이 한국 원전의 수출길을 완벽하게 틀어막아버렸다는 사실이다.

한국의 원전을 살리고 수출길을 열겠다고 도리도리질을 해가면 부처에서, 한전과 한수원에서 작성해 준 각종 발표문을 읽어댔다. 자신의 말과 행동이 무슨 의미인지조차 알지 못하는 윤석열에게는 오직 건희랑 체코에 놀러가야 한다는 생각밖에 없었다.

그리고, 무조건 웨스팅하우스가 요구하는 대로 모든 조건을 다 들어주더라도 계약을 체결할 것을 종용한 것으로 보인다. 그리고, 이전 글에서 언급한 조건들로 인해 우리나라는 체코에 원전을 지어도 결국 남는 건 없이 혈세로 형성된 국부를 유출해야 하는 상황에 맞닥뜨렸다.

UAE는 이미 적자, 이집트는 이번 약정으로 철수 확정!!

하지만, 그것만이 아니다. 이런 상황에 쓰라고 있는 단어가 있다. '철통'. 한국의 원전수출은 이제 윤석열에 의해 철통같이 막혀 버렸다. K-원전 자체를 붕괴시킨 것이다.

한수원·한전은 웨스팅하우스가 제기한 지식재산권(IP) 분쟁을 합의로 마무리하기 위해 지난 1월 50년간 유효한 협정서를 체결했다. 협정서에는 원전 수출 1기당 8억2500만달러(약 1조1400억원)를 물품·용역 구매, 기술 사용료 명목으로 지급하고 한국 기업이 SMR 등 독자 노형을 개발해도 웨스팅하우스가 기술 자립을 확인해주지 않으면 제3국에 수출하지 못한다는 조항도 담긴 사실이 최근 며칠 사이에 알려졌다.

한국 원전을 위한 나라는 없다. 지구 그 어디에도...

합의문에는 한수원·한전이 원전 수주 활동을 할 수 없는 국가 명단까지 첨부된 것으로 전해졌다.

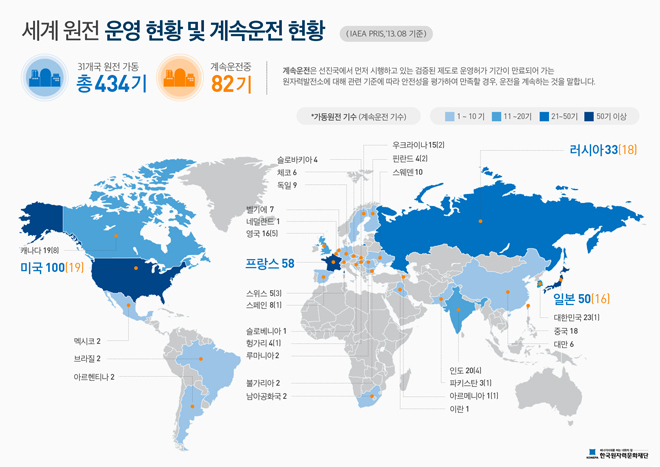

동남아시아(필리핀·베트남), 중앙아시아(카자흐스탄), 남아프리카, 북아프리카(모로코·이집트), 남미(브라질·아르헨티나), 요르단, 튀르키예, UAE, 사우디아라비아 등에서 신규 원전 수주 활동을 할 수 없도록 명시했다.

나아가 북미(미국·캐나다·멕시코), 체코를 제외한 유럽연합(EU) 가입국, 영국, 일본, 우크라이나 등은 웨스팅하우스만 진출할 수 있다고 적시된 것으로 알려지고 있다.

심지어, 한수원은 유망 수출지역이던 폴란드에서도 사업 철수를 공식 인정했다. 황주호 한수원 사장(놈)은 국회에서 폴란드 사업 철수 계획을 묻는 질의에 “일단 철수한 상태”라고 답했다.

웨스팅하우스는 '조지 웨스팅하우스'가 에디슨에 대한 경쟁기업으로 설립한 전기 회사다. 에디슨이 설립한 멘로파크 연구소의 유럽 지부에 채용된 '테슬라'를 데려다가 에디슨과의 직류와 교류 전쟁(Current War)를 촉발시킨 인물이다. 에디슨을 파렴치한 인물로 만드는 데에 테슬라의 과학자 이미지가 철저히 이용되었지만, 현재 웨스팅하우스는 한국의 미래를 빼앗은 기업이 되어버렸다. |

2025년 1월 웨스팅하우스와 IP 분쟁 타결 이후 스웨덴, 슬로베니아, 네덜란드에 이어 폴란드에서도 사업을 접기로 했다. 한수원이 유럽 등 주요 시장을 줄줄이 포기하는 계약을 맺어 놓고도 원전이 살 길이라고 외쳤던 것이다.

그래도 일말의 희망을 찾고자 하는 사람이라면, 아래의 지도와 함께 원전 수출 가능성이 있는 나라가 과연 있는지 하나하나 짚어가면서 원전 수출에 대한 희망 불씨를 살려보기 바란다. 단, 러시아나 중국의 세력권에 있는 지역과 나라 정도는 알고 있겠지?

현실적인 데이터들을 두고도, 원전에 대한 그 어떤 전문성도, 그 어떤 의식도 없는 윤석열과 황주호를 믿는다면, 이건 과학과 기술의 문제가 아니라 단지 집단 사이비 종교에 열을 올리는 수준에 불과한 것이다.

원전수출을 아직까지도 주장하고 믿는 자들은 자신이 윤석열에게 철저히 속고 유린당한 사실을 인식조차 못하든지, 절대 믿고 싶지 않은 것일 뿐이다. 현실은 한국 원전은 이제 없다는 것이다. 한국 원전에 조종을 울린 윤석열도 그 행렬에 함께 하게 될 것이다.